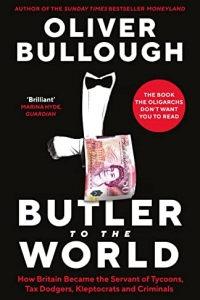

Butler to the World (2022)

- Auteur: Oliver Bullough

- Editeur: Profile Books (10 mars 2022)

- Pages: 279 pages

- Langue: Français

Description du livre Butler to the World (2022):

LONGLISTED FOR THE FINANCIAL TIMES BUSINESS BOOK OF THE YEAR 2022

THE SUNDAY TIMES BESTSELLER

PRESENTER OF THE BBC RADIO 4 SERIES 'HOW TO STEAL A TRILLION'

AS SEEN ON LED BY DONKEYS

'Brilliant'

Marina Hyde, Guardian

'A savage analysis of Britain's soul. As essential as Orwell at his best'

Peter Pomerantsev

'Horribly brilliant'

James O'Brien

How did Britain become the servant of the world's most powerful and corrupt men?

From accepting multi-million pound tips from Russian oligarchs, to enabling Gibraltar to become an offshore gambling haven, meet Butler Britain...

The Suez Crisis of 1956 was Britain's twentieth-century nadir, the moment when the once superpower was bullied into retreat. In the immortal words of former US Secretary of State Dean Acheson, 'Britain has lost an empire and not yet found a role.' But the funny thing was, Britain had already found a role. It even had the costume. The leaders of the world just hadn't noticed it yet.

Butler to the World reveals how the UK took up its position at the elbow of the worst people on Earth: the oligarchs, kleptocrats and gangsters. We pride ourselves on values of fair play and the rule of law, but few countries do more to frustrate global anti-corruption efforts. We are now a nation of Jeeveses, snobbish enablers for rich halfwits of considerably less charm than Bertie Wooster. It doesn't have to be that way.

Commentaires

In 1962 the former American Secretary of State Dean Acheson famously said that Britain had lost an empire and not yet found a role. In this book, which is a follow-up to Moneyland, his earlier book on the same subject, Oliver Bullough argues that Britain has now found its role, namely butler to the world.

If this sounds a bit of a comedown from Britain's earlier role of running the greatest empire that the world has seen in modern times, then that is right. What is butlering in this context? It is the City of London together with the legal and accountancy professions using their skills to help the super-rich hide their wealth offshore, evade tax and avoid having to account to anyone except themselves.

Bullough traces the growth of offshore finance from the 1950s onwards and shows that Britain has been one of the countries at the centre of it. Indeed many of these offshore financial centres are former British colonial possessions too small to win independence but granted a considerable degree of political autonomy as British Overseas Territories. Examples given are the British Virgin Islands, Anguilla and Nevis but there are others. Bullough shows how they have developed a lucrative trade in setting up so-called shell companies to which individuals with money to hide can transfer their wealth. This can be kept secret because it is a feature of these companies that there are no obligations to make public the identity of directors and shareholders and little or no reporting obligations. All one needs is a controlling interest in one of these companies with a bank account or accounts attached and the process can begin.

These arrangements attract varied classes of persons from politicians who have used their power to siphon off enormous wealth from their own countries to criminals wishing to hide illegally acquired profits from drug smuggling and other activities. Setting up these arrangements costs money of course and this is where the butlering services come into play.

For many years these practices were tolerated by successive governments which did not want to interfere with the City of London's financial earning power because they could see spin-off benefits for Britain. The arguments used to defend these activities were very simple. If we do not do it someone else will and there is no point in one country acting alone because the practices can only be stopped by nations acting in concert. More recently public pressure had caused the British government to take some legislative action mainly by creating unexplained wealth orders but Bullough shows how difficult is for poorly resourced state agencies to fight against the legal teams that the super-rich can assemble to avoid having their improperly acquired wealth confiscated.. More needs to be done and in particular Britain needs to stop British Overseas Territories from creating the kinds of financial regimes and loopholes which allow this shadowy financial world to flourish.

Britain does not come well out of this book but that is no reason for rejecting it. Anyone who cares about justice should support measures to rein in the abuses of power and the crimes at the heart of offshore finance.

5/5

Télécharger Butler to the World (2022) gratuit

Livres similaires